sa.global

Sponsor comment

How is legal business being shaped by technology?

Our most detailed and expansive picture yet of legal business priorities when it comes to turning technology into strategic advantage

Sponsor comment

Law firm comment

Sponsor comment

Sponsor comment

Law firm comment

Sponsor comment

Law firm comment

Sponsor comment

Law firm comment

Sponsor comment

Law firm comment

Sponsor comment

Welcome to the future of our Legal IT landscapes research, dear Briefing readers. From now on, LITL will form part of our growing Frontiers research and horizons-scanning work at Briefing, which covers reports and our Frontiers events. In the past, LITL has only quizzed IT leaders and a few other roles in-the-know about IT. But in this year’s research we’ve extensively expanded our remit to question leaders in finance, IT, operations, KM, innovation and marketing/BD, to gain a more rounded understanding of the intersection of law firm business strategy and technology.

Welcome to the future of our Legal IT landscapes research, dear Briefing readers. From now on, LITL will form part of our growing Frontiers research and horizons-scanning work at Briefing, which covers reports and our Frontiers events. In the past, LITL has only quizzed IT leaders and a few other roles in-the-know about IT. But in this year’s research we’ve extensively expanded our remit to question leaders in finance, IT, operations, KM, innovation and marketing/BD, to gain a more rounded understanding of the intersection of law firm business strategy and technology.

We will be building on this remit further in the future. For now, if you could wave a magic wand, what would you do to improve your firm’s profitability? What sort of work is your innovation team focused on, does that make a difference to how it’s all set up and structured, and are you selling the results to clients? And what’s really happening (or not) around productisation in today’s big firms? Alongside longstanding polling on the trends in competition for clients, flexible/ agile working, cybersecurity priorities and the destinations for automation, read on for our most detailed picture yet of legal business priorities when it comes to turning technology into strategic advantage.

If you like the sound of this, don’t miss our annual Briefing Frontiers 2020: Legal IT landscapes event, 27 February 2020 in London. Click here to find out more.

This year, Briefing asks firms the following questions:

-What are your biggest threats in 2020?

-Are innovation initiatives delivering the goods?

-Do you have the money you need to compete?

-Where can automation investment make most difference?

-What are your biggest cyber pressure points?

-How are your working patterns and places changing?

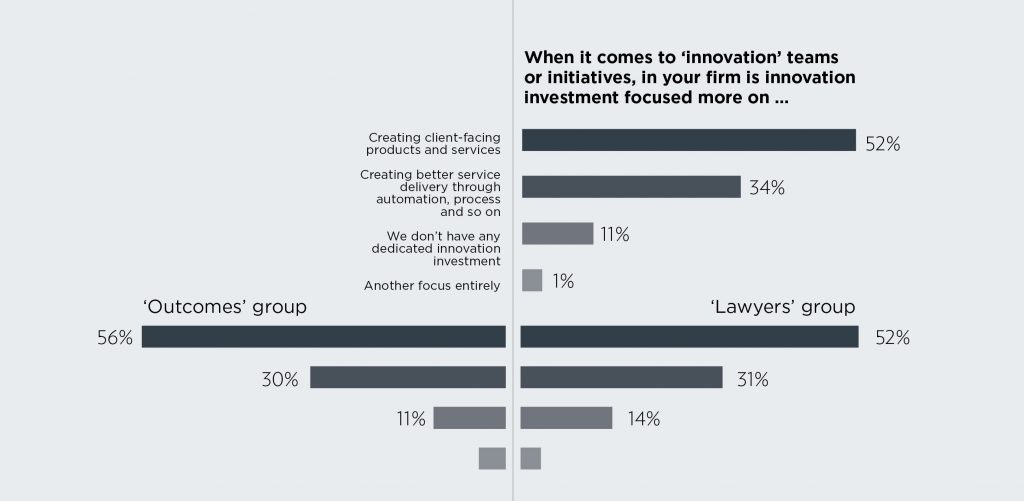

We can see a shift from last year’s results in terms of how money is being spent within innovation tasks (see above). In 2018, we found a perfectly equal balance between ‘client-facing products and services’ and ‘creating better service delivery through automation and process improvement’, both at 37% – this year the former number rose to just over half (52%), while the latter dropped slightly to a third (34%). So, it’s looking like firms are increasingly shifting the focus of their innovation efforts towards client-facing ends. Likely reflecting the rise in innovation spend overall, we also found that the number of ‘we don’t have any dedicated innovation investment’ respondents shrank from a fifth (20%) in 2018 to nearly half that figure (11%).

When we asked business services leaders which competitors were most threatening to their firms’ futures, the ‘standard competition’ (similar law firms) came out on top with 29% – not significantly higher than the 26% figure from last year. The ‘standard competition’ is those firms that have a similar business model – relatively familiar ground. Stuart Whittle, business services and innovation director at Weightmans, defines it as “firms who operate in our version of the legal market, where we have expertise and they have similar expertise, looking to work for similar clients.”

Clients are increasingly auditing law firms to reassure themselves that their data is secure, as vulnerabilities exist throughout the chain of processes that clients and firms interact through. But is the perception of the threats out there changing? This research certainly suggests clients are more concerned. An eye-wateringly high 87% of respondents said that they had seen an increase in the number of clients performing security audits on them. That’s a jump from the already high figure of 72% last year. Curiously, if we split the results between the ‘outcomes-focused’ firms and ‘lawyer-focused’ firms, we see the figure drop to 75% in the former and jump to 92% in the latter (p30).