LexisNexis Enterprise Solutions

Sponsor comment

Where is legal technology strategy changing as we enter 2019?

Where are firms' top tech investments transforming legal business life in both efficiency and competitiveness?

Sponsor comment

Sponsor comment

Sponsor comment

Sponsor comment

Sponsor comment

Sponsor comment

From machine learning to management information, portals to pricing, Legal IT landscapes 2019 once again reveals which areas of tech lie where on Briefing‘s axes of law firm efficiency and competitiveness; probes how much you’re investing in business future-proofing; and this year, for the first time, asks where the trend for greater innovation is being directed. Could the market be facing a stark choice between one strategic direction and another?

From machine learning to management information, portals to pricing, Legal IT landscapes 2019 once again reveals which areas of tech lie where on Briefing‘s axes of law firm efficiency and competitiveness; probes how much you’re investing in business future-proofing; and this year, for the first time, asks where the trend for greater innovation is being directed. Could the market be facing a stark choice between one strategic direction and another?

Analysis includes:

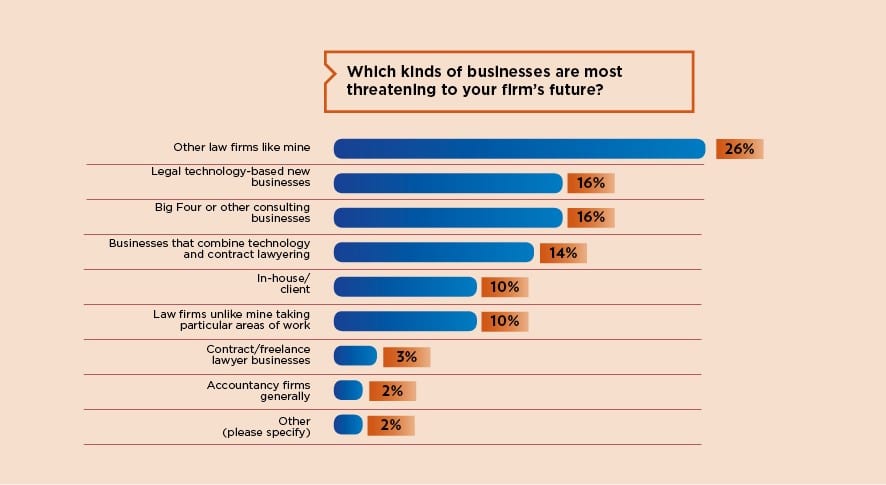

Which kinds of businesses are most threatening to your firm’s future? The big news is that the Big Four are rising in those particular ranks. However, legal IT leaders appear to be seeing no significant change in their level of executive/decision-making power to invest and counter new competitive forces.

For 2019, we asked respondents to consider whether clients were more likely to buy them for the quality/knowledge of their lawyers or the quality/delivery of their outcomes. And it’s noteworthy that this also seems to split firms along innovation lines. More than half of ‘outcome’ firms (56%) channel most innovation investment into client-facing products/ services, while the lion’s share in ‘lawyer- first’ firms goes on improved service delivery (45%).

We know that plenty are making strong progress in the world of document/contract automation – which is not to underplay its continuing high score for efficiency by any means. However, for 2019, we asked where firms were applying ‘robotic process automation’ (RPA), either right now or within the next 18 months.