Briefing/HSBC UK law firm strategy survey 24-25

reports|September 2024Where are law firm leaders prioritising focus for the next 12 months?

INSIDE

How are all the top items on leading law firms' transformation to-do-lists, priority rankings and risk radars shifting, with artificial intelligence also in on the process action?

WHAT'S ALL THIS?

What do the largest law firms active in the UK intend for the next phases of their strategic growth and business transformation? Where must they invest to change or improve their infrastructure or processes as a priority through 2024, and where do they see the competitive landscape and specific external or internal pressures accelerating or changing?

The Briefing/HSBC law firm strategy and investment research 2024/2025 is the outcome of an annual survey of almost 100 senior strategic legal business leaders – CEOs, managing partners, chief operating and financial officers – at all the leading UK-based law firms.

All responding firms have annual revenues of at least £18m, extending to those with the very largest and most complex networks of organisational challenges to navigate. The research was carried out in summer 2024, and key findings are clearly explained and connected with practical context. Briefing also interviews respondents from firms of all sizes represented to understand more about the challenges and priorities in their own worlds.

Strategic challenges and choices explored include appetite for expansion, the competitive landscape in legal and alternative business models, the most significant of today’s operational pressure points, the need for new or improved technology in particular, and firms’ focus on both sustainable financial management and environmental social responsibility (ESG).

- Firms are confident of future growth — but find talent is the top challenge to it.

- Lateral hires are the most likely route to growth in a market feeling this and other pressure — but there’s also strong interest in M&A opportunity.

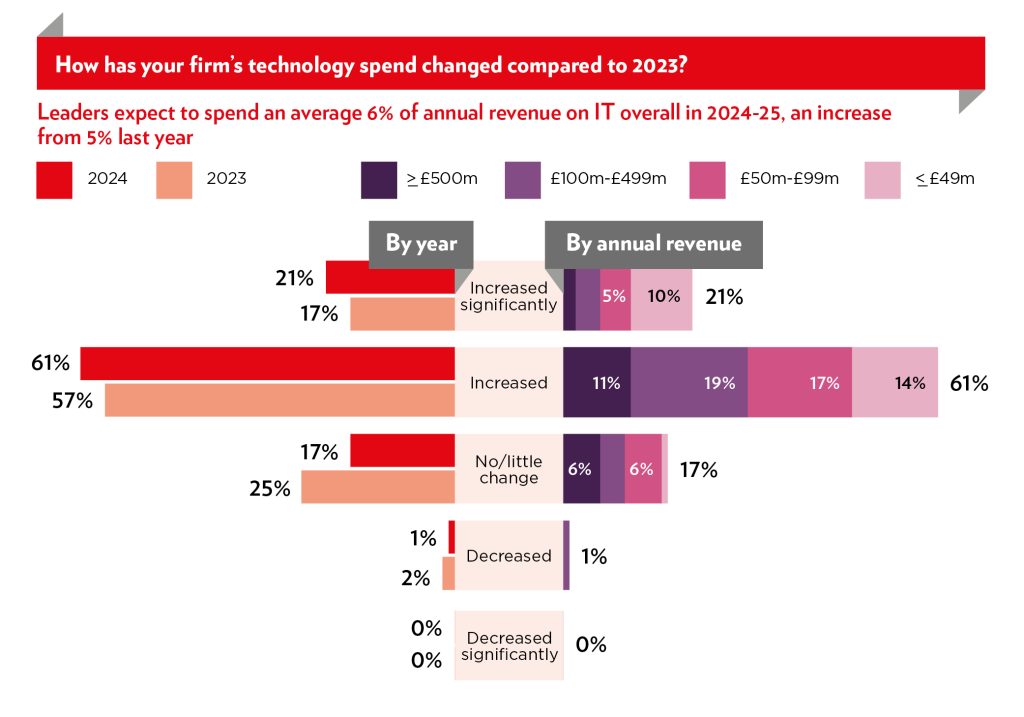

- Average estimated spend on IT systems/solutions — and their support — has risen, with expectations of AI-augmented working high.

- More firms are formalising their goals for sustainable business progress (ESG).

Read Briefing and HSBC’s law firm strategy and investment research 2024-2025 with the Briefing app now:

- Download and read Briefing and HSBC’s law firm strategy and investment research 2024 via our app on Android

- Download and read Briefing and HSBC’s law firm strategy and investment research 2024 via our app on iOS

- Read Briefing and HSBC’s law firm strategy and investment research 2024 on the app web browser.

The survey report is also available as a pdf here.

Firms confident of future growth, but talent is the top challenge

Availability of talent is the top challenge identified by leaders planning any form of strategic growth (cited by 59%) — far ahead of concerns around the volume or complexity of changing regulation (12%), variable results in terms of profitability (12%) or the clear escalation in geopolitical conflict in 2024 (16%). Only 12% indicate that securing finance for their growth plans is a top challenge, compared to 31% identifying this in 2023.

Average technology spend rises to transform efficiency and respond to shifting risks

The average (mean) sum leaders believe their firms will be investing in technology throughout 2024-2025 (including to secure the people with expertise in delivering or developing it) is 6.1% of total annual revenue. It’s an increase from 5.7% in 2023 — and for a fifth it’s a spend that has increased significantly (three-fifths noting at least some increase). Firms may be highly aware of a need to become more efficient in different respects, from data management to document creation and delivery — or indeed to support client onboarding and engagement through new interfaces — to compete in their markets more effectively.

Spotlight on sustainable success

Almost half (49%) of firm leaders now say that clients “always” or “regularly” enquire about business sustainability or workforce diversity targets and wider ESG policies before instructing them.