Briefing Database: FEBRUARY 2020

The 2020 State of the US legal market report reveals some incremental

financial improvements, but suggests a significant productivity problem

WHICH LAW FIRM PERFORMANCE INDICATORS DEMAND MOST ATTENTION?

WHICH US PRACTICE AREAS ARE EXPERIENCING MOST GROWTH IN HEADCOUNT?

_______________________________________________________________

Peer Monitor Perspective

_______________________________________________________________

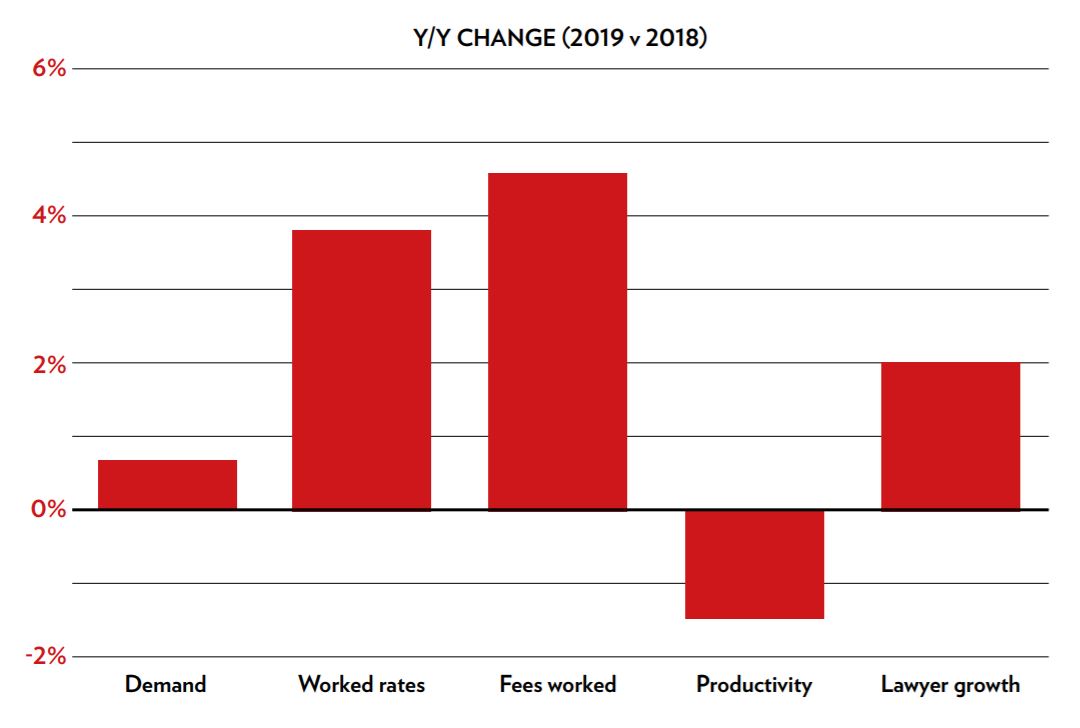

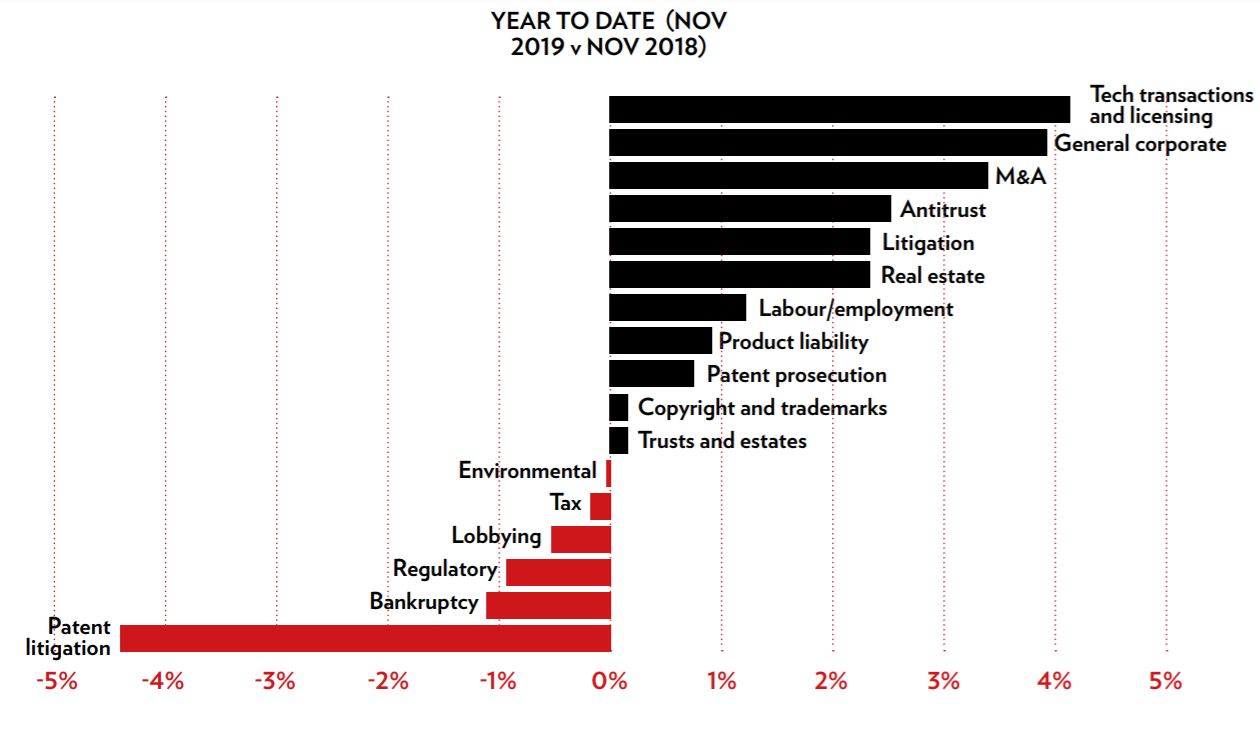

During 2019, most US firms experienced fairly steady overall financial performance, with demand, rates and headcount all growing. While demand grew at a slower pace than in 2018, rate and headcount growth exceeded the year prior.

In spite of these gains, some worrisome trends have emerged, not least the negative performance in productivity and continued lacklustre demand growth, which has essentially been flat to somewhat negative over the last decade.

Growth rates for direct and indirect expenses continued to rise, a trend over several years, and there appears to be too much reliance on rate increases to drive firms’ positive financial performance.

Source: Thomson Reuters Peer Monitor data is based on reported results from 162 US-based law firms, including 51 AmLaw 100 firms, 54 AmLaw second hundred firms, and 57 additional midsize firms. Click here for the full report.

In partnership with Peer Monitor

This article can be found in Briefing‘s February edition: COO your future